Natural Gas Supply/Demand Scenario Simulations Reveal Looming Supply Deficit

Massive expansion in North American LNG capacity threatens to switch the U.S. natural gas market from surplus to deficit

This publication is building on a previous article of mine: “The Future of Natural Gas - A Data-Driven Perspective” (introduction to the thesis).

From Natural Gas to Liquified Natural Gas (LNG)

Let’s start with a short recap on the natural gas thesis:

In the rapidly evolving global energy landscape, natural gas emerges as a critical transition fuel, especially as the scalability and reliability of renewable energy sources remain uncertain. The first article underscores the steady growth in global demand for natural gas, with the U.S. positioned as a pivotal player due to its status as the world's largest producer.

Despite a projected decline in U.S. domestic consumption, the country's significant production surplus, primarily driven by the shale revolution, presents a unique opportunity for lucrative LNG exports. This surplus, coupled with substantial international price disparities, positions North American LNG as a key component in global energy security and an attractive investment prospect.

Massive Ramp-up in North American LNG Exports (2025+)

Figure 1 presents a massive ramp up of the North American LNG capacity (projects under construction) as estimated by the EIA. This expansion is indicative of North America's strategic move to enhance its role in the global LNG market, leveraging its vast natural gas resources to meet international energy demands and capitalize on economic opportunities presented by global price differences.

Figure 1. Annual North American LNG export capacity 2016-2027 (Source: EIA, November 2023).

The North American LNG export capacity is set to approximately double by 2025 (from ~11 bcf/d to 20 bcf/d) and is estimated to triple by 2030 (~30 bcf/d). These are mind-blowing numbers!

Inevitably, this raises the question: Can this massive expansion in demand be met with existing domestic production and inventories?

U.S. Natural Gas Supply Demand Model

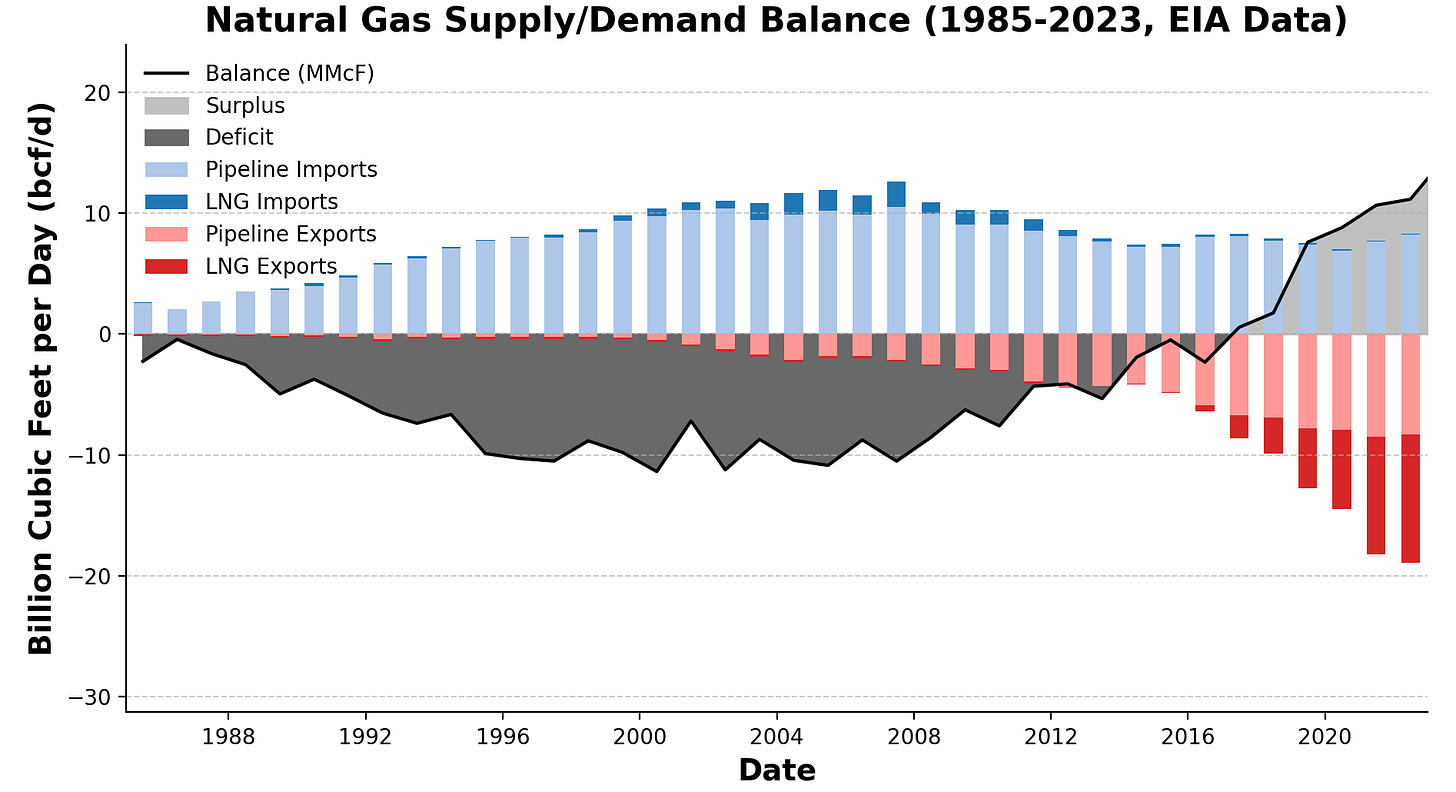

In order to address that question, we have to turn back to the supply/demand balance model I have developed in my last article (Figure 2). As highlighted in the light grey shaded area, U.S. natural gas has been in an increasing surplus (dry gas production minus total domestic consumption) since around 2015.

In 2022, the EIA reported a domestic production surplus of around 11 bcf/d. However, after correcting this number for net pipeline and LNG imports, the net surplus ended up only around 0.5 bcf/d.

Figure 2. U.S. natural gas supply/demand model (dry gas production and total consumption). LNG exports are highlighted in dark red (Data Source: EIA, October 2023).

Given that we have a good estimate of the projected LNG capacity increase (Figure 1), we can start modeling different scenarios for domestic production and consumption to predict the future net balance.

Figure 3 shows 4 different scenarios for the U.S. natural gas supply/demand balance.

The results are simply put: astonishing and provide an exceptional opportunity for investors in the space for 2025 onwards.

Here are the assumptions for the different scenarios:

EIA Reference Scenario:

Production: 5% production growth from 2022-2024, then a sharp decline by 7% in 2025 and no production growth until 2028.

Consumption: Stable consumption until 2024, then a sharp decline by 10% in 2025 and a 0.8% demand decline until 2028.

Comments: Reasonable assumptions until 2024, then a massive underestimation of production (and even more so) consumption. EIA assumes a massive decline in natural gas demand due to a displacement of gas-fired energy by renewables. Upon close review of their assumptions, numerous overly optimistic (even unrealistic) expectations were uncovered. I will share these in an upcoming article.

Exxon Mobil Outlook 2050

Production: Annual production increase of 2% until 2028

Consumption: Annual demand increase of 0.5% until 2028

Comments: Very optimistic production growth increase, reasonable consumption assumptions (a bit on the lower end)

Oxford Energy Institute

Production: Annual production decrease of 0.5% until 2028

Consumption: No demand increase until 2028

Comments: Overly pessimistic assumptions on production and consumption growth.

GECF (Gas Exporting Countries Forum)

Production: Annual production increase of 1% until 2028

Consumption: Annual demand increase of 1.0-1.5% until 2028 (1.0% used for modeling)

Comments: Realistic assumptions for both production and consumption.

Note: The scenario simulation assumes 0.9 bcf/d LNG imports (average of 2020-2022) and uses the EIA reference pipeline net import assumptions (-1.8 bcf/d in 2023 and up to -4.7 bcf/d by 2028).

Also, the EIA estimates the LNG terminals to be able to operate at 105-108% of their nominal capacity 2023 onwards, which could add another 0.5-1 bcf/d of LNG capacity (not taken into account in simulation).

Figure 3. U.S. natural gas supply/demand scenario simulation based on four different forecasts (EIA Annual Energy Outlook 2023, Exxon Mobil Global Energy Outlook 2050 (2023), Oxford Energy Institute: “A New Global Gas Order? (Part 1): The Outlook to 2030 after the Energy Crisis” 2023 and GECF Global Gas Outlook 2050 (2023)). The net balance is calculated as: dry gas production - total consumption + pipeline imports - pipeline exports + LNG imports - LNG exports.

Remarkably, there’s no scenario where the U.S. production balances both domestic consumption and LNG exports before at least 2027 (and only for the very optimistic Exxon Mobil scenario).

In fact, the most realistic scenario (at least in my opinion), the GECF prediction, would result in a 4-6 bcf/d deficit from 2025-2028.

Now, the scenario simulation assumes that the EIA expectations of decreasing pipeline imports hold true. However, upon reaching an inflection point in the supply/demand dynamics, the U.S. might switch back to importing natural gas from Canada or decided to export less LNG.

In essence, the U.S. will always be able to meet their natural gas demand, it is only a question of the price. And this is where it becomes interesting.

Canada itself is expanding their LNG export capacity with the massive LNG Canada project (~2 bcf/d) expected to come online in 2025. Therefore, if they can export their excess gas to overseas consumers offering prices >$15/MMBTU (as of November 2023), the U.S. would need to pay up to secure gas.

If the modeled scenarios become reality in 2025 onwards, the U.S. market is at risk of switching from a structural demand surplus to a deficit driven by a massive expansion of LNG export capacity. This will be associated with a significant increase in domestic natural gas prices and poses an extraordinary opportunity for investors to front-run the predicted price appreciation.

How to Play This?

Make sure to subscribe for a small contribution of $6/month to get the full article here (incl. my opinion on how to play this + top stock picks) and more deep commodity research publications every month!

About me. Conducting this research is my passion. I’m holding a management position in big pharma (computational modeling) and I don’t want my day job to influence what I have to say here. Therefore, I made the decision to remain anonymous.

What makes this blog unique? I have a strong background in computational modeling (Machine Learning / AI) allowing me to dig deep into the data. This technical edge provides readers with sophisticated analytics that inform smarter investment decisions in the commodities space.

Disclaimer: As always, this is not financial advise and I’m not a financial advisor, always make your own investment decisions!

Keep reading with a 7-day free trial

Subscribe to Mineral Stocks to keep reading this post and get 7 days of free access to the full post archives.