Renewable energy is rapidly becoming a cornerstone of global efforts to reduce carbon emissions, but its intermittent nature poses significant challenges for consistent power supply. Solar and wind resources, while abundant due to heavy governmental subsidies, are not always available when and where they're needed, leading to a pressing demand for robust energy storage solutions.

Enter vanadium — the unloved element that could be the key to unlocking a stable, renewable future. Vanadium Redox Flow Batteries (VRFBs) have emerged as a potent solution to the energy storage conundrum, offering a way to store the power of the sun and wind. As investments flow in and VRFBs scale up, the demand for vanadium is poised for unprecedented growth, presenting a unique opportunity for investors tuned into the evolving landscape of the energy sector.

Vanadium Usage

Vanadium is widely used across several industries due to its enhancing properties:

Steel Production: Approximately 85% of vanadium produced is used as an additive in steel alloys, significantly enhancing their strength, hardness, and resistance to corrosion. This is critical for products like automotive components, pipelines, and construction materials.

Energy Storage: In 2023, an estimated 10% of vanadium demand came from Vanadium Redox Flow Batteries (VRFBs), which are emerging as a reliable solution for grid-scale renewable energy storage, capable of offering large capacity and long lifecycle.

Titanium Alloys, Chemical Catalysts and Aerospace/Aviation. (Remainder).

As we approach 2030, the vanadium market is set to experience dynamic changes. Demand for vanadium, primarily driven by the adoption of VRFBs in large-scale energy storage systems, is expected to surge (Figure 1).

Figure 1. Massive expected surge in annual installed VRFB capacity globally (Source: Energy Storage News, 2022).

But how significant are these increases in installed energy storage capacity in respect to their vanadium usage?

Vanadium Demand Model

Vanadium Flow Battery Demand

Let’s start with two models, a mid-term (until 2030) and a short-term assumption (2024/2025):

Largo, the world’s largest primary producer, estimates that China will be adding 180 GWh of VRFB by 2030, corresponding to approx. 1,400,000 tons of Vanadium pentoxide (V2O5) as shown in Figure 2. This is a very high number comparing to an annual supply of approximately 203,000 tons of V2O5.

In the shorter term, expected Chinese VRFB deployments as reported by FerroAlloyNet should amount to around 5 GWh in 2024 and up to 12 GWh in 2025.

To estimate the actual content of V2O5 (Vanadium Pentoxide) in VRFBs, we can refer to three reference assumptions:

Largo Inc. estimates. ~8,330 tV2O5/GWh.

Project Blue estimates: ~7,900 tV2O5/GWh

Australian Vanadium estimates: 11,200 tV2O5/GwH

We’ll assume a range of 7,900 - 11,000 tV2O5/GWh as a baseline.

Figure 2. China announces 180GWh of VRFB battery deployments by 2030, translating to 1.4Mio tons of V2O5 (Source: Largo Inc. Investor Presentation, February 2024).

Figure 3. Expected Chinese VRFB growth in 2024 and 2025 (Source: Future Facing Commodities Conference Presentation of Australian Vanadium, Singapore March 2024).

As shown in Figure 1, Asian VRFB growth (specifically from China) covers most of the expected vanadium demand in the shorter term, with significant follow-through by Europe and North America expected in the latter half of the decade.

For now, let’s focus on China:

Given those assumptions, we should expect a Chinese vanadium requirement of around:

Short-term:

23,700 - 33,000 tons of V2O5 in 2024 (~3GWh added, 11.7-16.3% of 2023 total global supply)

55,300 -77,000 tons of V2O5 in 2025 (~7 GWh added, 27.3-38.0% of total global supply)

Mid-term:

~200,000 tons of V2O5 in 2028 onwards (100%+ of total global supply)These numbers are extremely high and will require a significant supply response.

Now given that we’ve focused exclusively on China, how do these calculations compare to industry forecasts on a global scale? Figure 4 highlights 5 different demand growth assumptions based on CAGR (compounded annual growth rate) forecasts until 2030.

CAGR estimates range from a low of 8.5% to a high of 13-14% Guidehouse Insights and Largo Inc. Notably, the reported values are shown in tV, where 1 tV corresponds to about 1.79 tV2O5.

The worst case scenario assumes approximately a double in Vanadium demand between 2023 and 2030, the best case close to a triple!

Figure 4. Vanadium demand growth expectations based on industry forecasts.

Rebar Steel Demand

But what about steel? On July 24th, BNN Bloomberg reported that China has released new quality standards for rebar steel coming into action in September 2024 (Figure 5).

Figure 5. BNN Bloomberg article on new rebar steel standards in China (published 24th of July 2024)

2018-2024. The current standard has been established in 2018 in which rebar steel is required to contain a specific amount of vanadium for strength reinforcement (Figure 6A). What happened next? Vanadium prices skyrocketed (Figure 6B). However, the price increase was short-lived as Chinese producers quickly adapted and found ways around using reinforcing alloys like vanadium and turned to water-quenching. Mastermines (@VanadiumWorld) on X has written a great thread on this topic: https://twitter.com/VanadiumWorld/status/1818540415706075233

Figure 6. A) left. Vanadium content described in 2018 rebar steel standard in China (Vanitec News) B) right. Impact of rebar standard change on vanadium prices in 2018.

Today. Under the new standard, more controls will be in place to ensure appropriate mechanical properties as the standard is released under the label GB and not GB/T where “T” stands for recommended. In essence, China will crack down and enforce ferroalloys like vanadium to be used in rebar steel.

What could be the impact of such an enforcement of standards? Early estimates range from 15-25% of producers for which the rebar production does not meet the new standards (Figure 7). This could very well translate into a 20% incremental demand for vanadium in rebar once enforced. Given that China accounts for approx. 50% of global steel consumption, this might increase global vanadium demand by up to 10%!

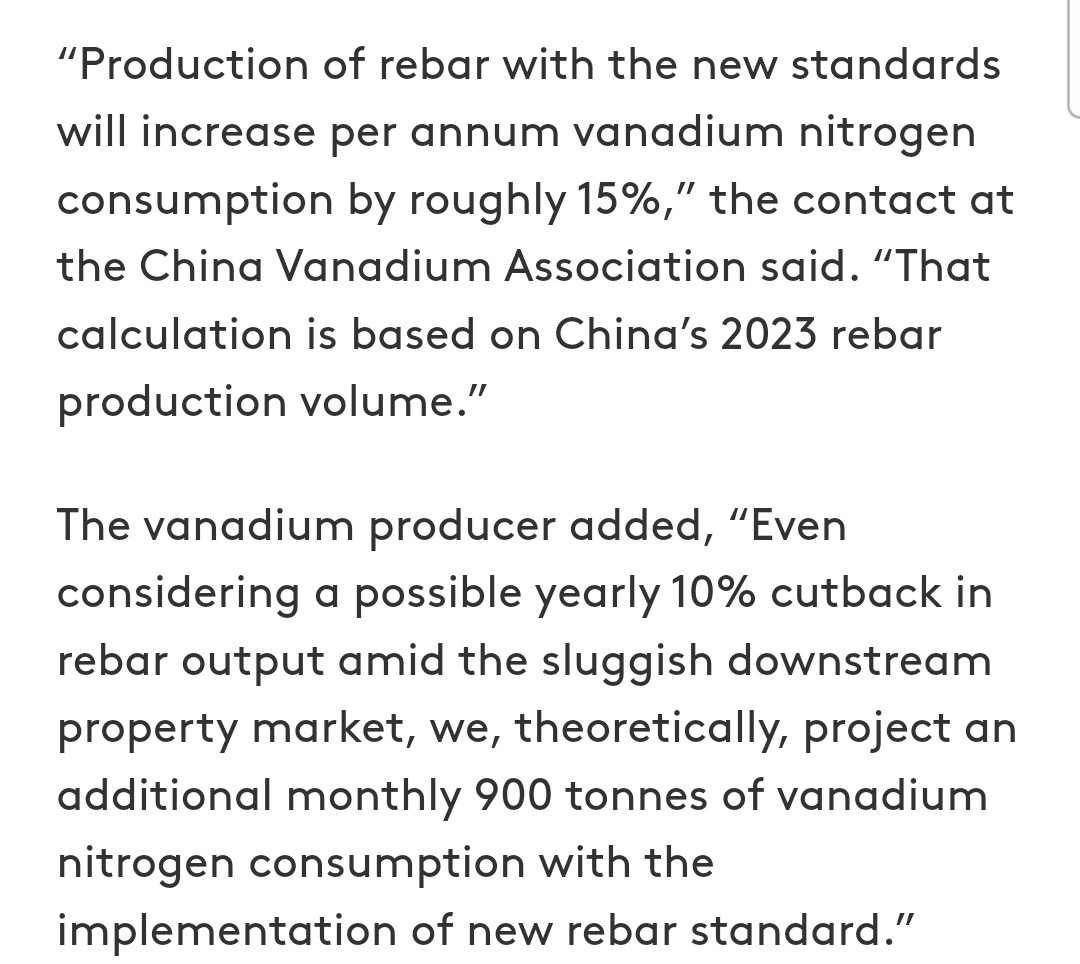

More confirmation for this estimate can be found by looking at a recent published interview with a contact at the Vanadium Association of China (Figure 8). To produce the incremental monthly demand of 900 tonnes of vanadium nitrogen, you need about 1545 tonnes of V₂O₅, considering a 77% vanadium content and an 80% production efficiency.

Note! This is a super rough calculation based on stoichiometric and recoveries as I'm no steel production expert whatsoever. Probably the estimate is a good scientific guess though. Importantly, this number takes into account a possible yearly 10% cutback in rebar output amid the sluggish Chinese property market. So this should be the true incremental demand number even under bad economic circumstances.

In any case, 1,545 tons of V2O5 per month result in ~ 18,500tons V2O5/ann. This is approx. 10% of incremental global demand. A number in line with the estimates shown in Figure 7.

Figure 7. Estimates of incremental vanadium demand for complying with new rebar standard in China. Taken from a post of @Alexsei88 on X, 24th of July 2024.

Figure 8. Estimates of incremental vanadium demand for complying with new new rebar standard in China. FastMarkets (published 30th of July 2024).

Notably, a recent Reuters article published July 24th mentions that Chinese steel traders seek a delay of the new rebar standard (Figure 9). It is likely that Chines authorities are accommodative to avoid business disruption and the standard will not be in place until early 2025.

Figure 9. Headline of Reuters article on potential delays in rebar standard implementation in China (published 24th of July 2024).

Bringing this all together: For 2025, on the demand side we can forecast a potential increase in global vanadium demand coming from rebar steel of ~10% and somewhere between 27-38% from VRFB demand (according to the VRFB estimates in Figure 3 provided by FerroAlloyNet and VR8).

A total increase of 35-45% of global vanadium demand from China alone in 2025 is extremely high and should significantly affect prices.

It becomes evident that the demand side of vanadium is about to skyrocket. The million dollar question here is though: can we expect an appropriate supply response?

In the next blog post, we need to model supply to understand if the vanadium market can absorb the rapidly increasing VRFB consumption requirements, as well as the new rebar steel standards. Also, what are the best ways to play this market?

Stay tuned and subscribe (and if you truly like it, I’d be delighted if you would pledge your support for only $8/Month to be the first to get access to more premium content)!

Excellent article. Looking forward to part 2

Where is Part 2? Did you give up on substack?