Investments in Uranium - A Data-Driven Perspective

Uranium on the Rise: Unpacking My X Research published September-October 2023.

What’s the Uranium Thesis (Brief Recap)

Having written numerous individual threads on uranium company valuations the past weeks, I felt the need to write up my insights on the uranium market. As a data analyst, my approach is rooted in the data, and the current state of the uranium industry presents an incredibly compelling investment case.

Important Note: None of this is financial advice, I’m by no means an expert on investing or mining. I’m a data analyst that loves to find patterns in data that help me make informed investment decisions. Do your own due diligence!

Figure 1: Visualization of the revised uranium supply and demand balance model by TD Cowen (October 2023).

Let’s start with some simple math:

Global Uranium Consumption: Current estimates indicate that the world's annual consumption of uranium is approximately 190-200 Mlbs.

The Supply Equation: On the supply side, the figures paint a different picture. We're looking at a total uranium supply of about 140-150 Mlbs. This encompasses secondary supplies (e.g. contributions from Russian sources, and sales from the Department of Energy (DOE)).

The Looming Deficit: The difference between consumption and supply has led to an annual deficit of roughly 45 Mlbs. Projections suggest that this deficit will persist until around 2028, when significant new mining projects, such as the Arrow deposits of Nexgen, PLS of Fission, and Phoenix of Denison, are anticipated to come online.

The Post-Fukushima Landscape (2011-2018): It's essential to understand that the market dynamics were altered considerably post Fukushima. Japan made the decision to shut down a majority of its reactors and there was millions of pounds of excess supply in the market (e.g. Megatons to Megawatts agreement where weapons-grad uranium was converted into 15,000 metric tons of low enriched uranium).

By around 2018, most of that excess supply was run down and a new supply deficit cycle began. The uranium market is at an inflection point.

Uranium Developers: The Investment Focus

There are several uranium developers gearing up to initiate production this decade. From an investment standpoint, these companies are likely the ones to watch. Why? Simply look back to the 2007 bull-run. Developers that managed to make it into production during that cycle outperformed all other stocks in that sector.

History might not repeat itself, but it often rhymes. Thus, it's worth considering these developers for potential investment. Of course, you can also play the explorers, but there you run the risk that they do not find any significant amounts of uranium and have there for no reason to go up in price.

In the end we make a bet on the price of uranium going up and we want to maximize our (risk-adjusted) leverage of that bet.

The uranium from developers, which goes from being pounds in the ground to actually mined pounds being sold, will see a significant increase in value. Consequently, developers that transition into production can expect a massive re-rate in the market.

Figure 2: Expected production roadmap for key uranium projects planning to come online this decade.

Current Valuations and Future Projections

A practical approach to estimate the valuation of commodity firms is by examining their Enterprise Value against their resources, essentially the "pounds in the ground."

I’ve done some work and collected valuation data on the entire space of uranium developers and producers both from the current market and from the 2007 cycle (Figure 3).

Figure 3: Uranium company valuations 2023 vs 2007 (Enterprise Value to Resources)

What’s striking about this is the relatively low median valuation across all companies in 2023. The median valuation in 2023 is about $1.6/lb. This means that for every pound of uranium they have yet to mine, the market values it at approximately $1.6. Looking back to 2007, close to its peak, it was around $8.1/lb. Significantly higher!

Notably, Brandon Munro (CEO of Bannerman Energy) has selected that post as the “Tweet of the Week” and published a video together with Crux Investor. You can find the video link below with his detailed interpretation of my graph around at the 35:55 mark.

“When we’re talking about a rising tide lifting all boats, that’s a good way of thinking about the degree of floatation of the boat […] There is still a vast gap of value to be closed between $1.6/lb as a median and $8.1/lb under 2007 and that has the right feel about it if you ask me.”

Brandon Munro, CEO of Bannerman Energy (October 2023) in response to Figure 3

Now, with the current price of uranium hovering at around $75/lb, it's evident that their unmined uranium is valued cheaply. For instance, if a company like Nexgen has an all-in sustaining cost of roughly $11, they could, in theory, gain a profit margin of around $64 per pound ($75 - $11). However, it’s essential to point out that these all-in sustaining costs might not reflect the true costs of production, especially when you factor in things like executive compensation and other overheads. Still, they give us a reasonable approximation for the relative comparison of the potential profitability of a uranium mine versus its peers.

So, if a developer, with a good profit margin, manages to acquire all necessary permits, successfully build a mine, and hire the required personnel, the resulting profitability will be evident in their cash flows, and the company's value will undergo a significant re-rating.

Looking back at the 2007 bull cycle, the median company was valued roughly 5x higher than today, even though the uranium spot price was at a similar level of $75 (it quite literally exploded after that to around $140 within less than 6 months). You might also have to account for inflation, but for simplicity, let's stick with this 5x figure.

Currently, we observe a significant lag in company valuations compared to the uranium price. I don’t know the exact reason for this. It could be due to broader market weakness, elevated interest rates, and a generally more risk-averse stance of investors.

But here's the silver lining for investors: if the market trajectory resembles that of 2007, investing in a well-diversified basket of uranium developers could potentially yield you a 5x return on your investment.

How do I pick my Bets?

While I won't mention individual companies in this discussion, I'd like to share my approach for identifying promising developers.

Timeline: My aim is to invest in developers which are set to commence production within this decade. This criterion alone significantly reduces the investable space. You can refer to my production roadmap that I’ve posted recently that should give a good overview on the expected production timelines for relevant uranium deposits (Figure 2).

Selection based on Production Likelihood: Next, I want to select developers that have a high likelihood of going into production as early as possible. That part is more of an art than a science and you have to read through investor presentations, listen to expert interviews and company conference calls, read analyst reports of Sprott, Cantor Fitzgerald, Shaw and Partners and many more. In short, do the work and follow your intuition.

Valuation and Costs: I want to understand if a company is attractively priced. What is the current company valuation and what are the all-in sustaining costs of the deposit. The Athabasca basin is home to the world’s largest and most cost-efficient deposits. These Tier 1 deposits should be the first that investors look at. However, some of them are already richly priced and their mines might be very difficult to construct as they’re remote (there’s not much infrastructure) and their deposits are at high depths which makes mine construction extremely expensive and difficult. In fact, some of them have initial capex requirements of more than 1 billion dollars. As a disclaimer: I do hold stakes in many of these companies as I like to echo Rick Rule's sentiment that “these mines will be mined”.

Price Sensitivity: Another pivotal aspect of my research involves understanding a company's sensitivity to the price of uranium. For instance, if a firm's production cost is $30/lb and the uranium price jumps from $60 to $90, their profit margin doubles (from $30 to $60). Yet, for a company with a higher production cost, say $50/lb, their profit margin quadruples (from $10 to $40). This phenomenon, is called 'optionality' and underscores how high cost projects, particularly those on the margin, can greatly benefit from soaring uranium prices. While low all-in sustaining costs generally indicate a good economic viability of a mine, higher cost projects are much more speculative as they require high prices to become viable. Nevertheless, given that our thesis is that the price of uranium has already gone up a lot and will go up much more, these companies represent the highest possible leverage in the space and therefore also the biggest opportunity in my opinion.

Through my analysis, especially around the price sensitivities of specific uranium developers, I've found that projects in Africa like Namibia, Niger, and Zambia tend to offer superior optionality. I've personally invested in several of these stocks.

In order to determine the uranium price sensitivity and, thus, level of optionality that different uranium companies offer, I've analyzed numerous Equity Research Reports from Sprott and Bell Potter from 2022/2023.

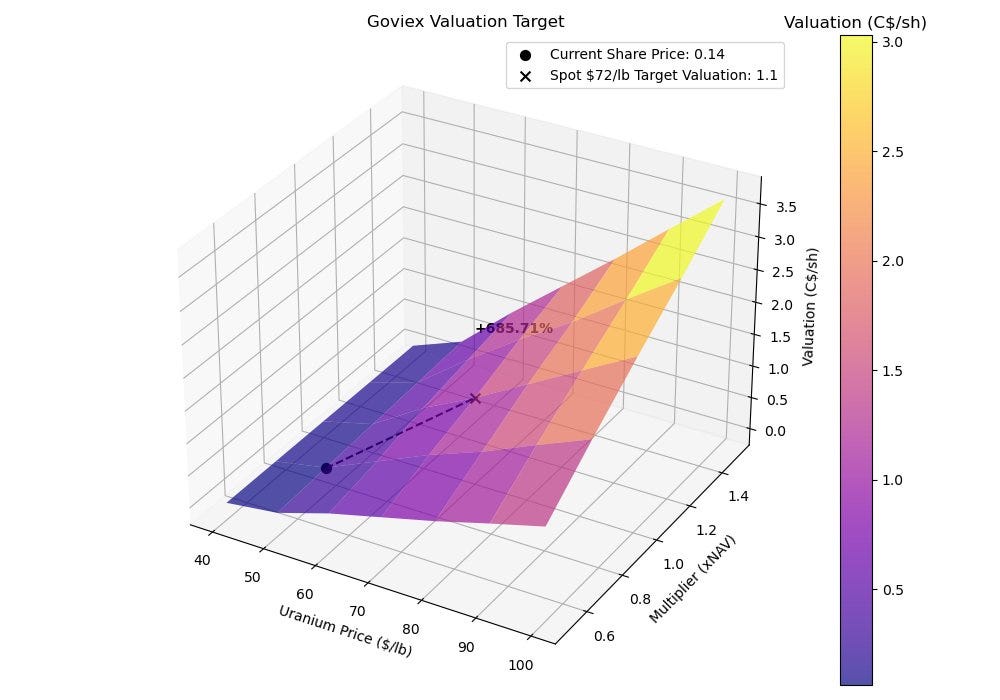

Figure 4 shows the uranium price and NAV multiplier sensitivity of 3 selected uranium developers: Nexgen, Deep Yellow and Goviex. Upon closer inspection, it becomes clear that the higher costs deposits of Deep Yellow and even more pronounced for Goviex feature a steeper increase of the valuation plane with rising uranium prices.

Remarkably all of the three stocks and most of its peers I analyzed factor in an uranium price of around $50/lb. At a spot price of around $75/lb at the time of writing this article, this represents a very compelling investment opportunity.

Figure 4: Uranium price and NAV multiplier sensitivity of 3 selected uranium developers: Nexgen, Deep Yellow and Goviex

Constructing a Well-Balanced Uranium Portfolio

Finally, bringing this all together let’s talk about a balanced portfolio construction. Again, this is my personal approach and might not be suited for your investment style.

Some thoughts:

Lack of Certainty: Even with intensive research, I don’t have a crystal ball and I can't predict the future. Investing is as much about risk management as it is about spotting opportunities.

Diversified Exposure: I want to construct a portfolio that benefits from a rising uranium price, unaffected of jurisdictional, operational and financial risks of individual companies. For my own investment strategy (and this isn't financial advice), I've built my portfolio around a core position in the Sprott Uranium Junior Miners ETF (URNJ). This ETF provides a broad exposure to top-tier developers, excluding Cameco, Kazatomprom, and SPUT. In essence, this allows me to participate in the market-wide valuation re-rating of stocks that I expect from my and other smart investors’ research. Reminder, I’m referring to the 5x increase in median company valuations to close the gap to the 2007 valuation levels. I want to have the security to be able to capture this market move. Imagine being right on the uranium thesis and picking the wrong stocks… I don’t want to risk that.

Physical Uranium Stake: On top of the ETF core position, around 25% of my portfolio is in physical uranium (SPUT), because I do see a world in which the uranium spot price goes on a massive spike and outperforms even the equities as utilities panic. I want to prepared for such a scenario.

High-Conviction Choices: Despite the safety of the ETF, I'm also keen on emphasizing certain URNJ ETF components where my research gives me strong confidence. I've handpicked approximately 10 individual stocks, based on my findings, that I believe hold promise for significant returns in the coming years and overweighed them in my personal portfolio.

Utilizing Options: Earlier this summer, I also ventured into long-dated call options on the URA ETF, which have since prospered and are now "in the money." This move offers me an avenue to gain extra leverage, but their timing is crucial. I only consider buying long-dated call options during phases of low volatility and depressed equity prices.

In Conclusion

To wrap things up, I want to emphasize again the importance of managing risk and making sure to participate in the uranium thesis itself which is: a supply deficit leading to higher uranium prices.

Do the research, learn about the companies you invest in and don’t play the lottery and risk to miss this train, because the gains in this trade could be absolutely life-changing.

Due to compliance reasons a LOT of your readers, read the Substack or X but do nothing (comment or reply). That s my case: I m an institutional investor from europe and usually never do anything

. Congrat again!!

Excellent article - many thanks for your research. I'm a long(ish) term investor in Uranium so am aware of the thesis and the likely restart dates for the mines, however your analysis on target prices based upon spot price and the last cycle is of exceptional value. Thanks again